Buyers of larger boats over 25 feet will sometimes hear the terms “boat insurance” and “yacht insurance” used interchangeably. It’s a mistake to assume these are simply two terms for the same thing, because that’s not the case at all. So what’s the difference between boat insurance and yacht insurance?

Where most insurance companies are concerned, “boats” are generally considered to be 26 feet in length or less, while “yachts” start at 27 feet and go up from there.

Yacht insurance is generally more comprehensive than boat insurance, because yachts typically include features not found on smaller boats, such as full galleys with stoves, full washrooms with showers, sleeping accommodations, heaters, air conditioners, much more elaborate electrical systems, and numerous other amenities that make them more expensive to repair or replace.

Because yachts are designed to be lived aboard for long cruising holidays, insurance companies consider them to likely travel farther than boats will, and therefore be exposed to different risks.

Protection and Indemnity

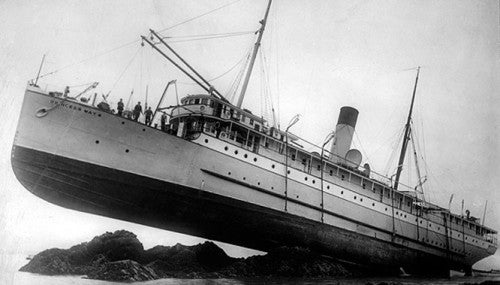

Protection and indemnity is the term used to describe liability insurance on either boat or yacht policies. In addition to paying for damage you might cause to other boats, it provides additional coverage for legal costs, wreck removal, salvage fees and pollution damage caused by the boat.

P&I coverage for yachts is generally more extensive than for boats – mainly because a 20,000-pound yacht has the potential to do more damage to anything it hits than a 2,000-pound boat will.

Boats are generally defined as water craft of 26 feet or less. Those 27 feet or greater in length are typically considered to be yachts. Yachts also tend to contain considerably more equipment and more complex systems.

Warranties

We usually think of a warranty as a guarantee that the consumer will be protected from manufacturing defects. But warranties go two ways. Where yacht insurance is concerned, warranties guarantee the insurance company that the boater will hold up their end of the deal.

For example, a yacht owner is generally required to maintain his boat and keep up with any required repairs. The policy may require the owner agree the yacht is to be used for pleasure use only, and warranty that it will not be operated as a charter boat. A fire extinguisher warranty would require the owner to comply with applicable regulations regarding fire extinguishers on board.

Warranties are extremely important, because failing to observe them could void your coverage.

So Which Coverage Do You Need?

Deciding which level of coverage – boat insurance or yacht insurance – comes down to how you use your boat, and is a conversation you should have with your insurance broker. If you use the vessel primarily for day trips, boat insurance may fit your needs without incurring the extra cost and coverage of a full yacht package. That’s especially true if your boat fits into that grey area between 25 and 30 feet. A 28-foot center console fishing boat, for example, might automatically be considered a candidate for yacht insurance on the basis of its length, even though it would never be used for extended cruising. Your broker can help you select the coverage that makes the most sense.

Fort Lauderdale International Boat Show Preview

Fort Lauderdale International Boat Show Preview 10 Best New Boat Accessories at IBEX 2021

10 Best New Boat Accessories at IBEX 2021 2022 Sea-Doo Switch Pontoon Boat Lineup Unveiled

2022 Sea-Doo Switch Pontoon Boat Lineup Unveiled BRP Enters Fishing Boat Market with Purchase of Alumacraft Boat

BRP Enters Fishing Boat Market with Purchase of Alumacraft Boat Volvo Commits To Electric Power By 2021

Volvo Commits To Electric Power By 2021 Starweld Victory 20 Review

Starweld Victory 20 Review Princecraft Ventura 23 RL Review

Princecraft Ventura 23 RL Review Scout 281 XSS Review

Scout 281 XSS Review Sailfish 312CC Review

Sailfish 312CC Review Fuel Saving Tips For Boaters

Fuel Saving Tips For Boaters Best Boating Accessories

Best Boating Accessories Best Boating Apps

Best Boating Apps 5 Pontoon Boats That Are Made To Fish

5 Pontoon Boats That Are Made To Fish 10 Great Small Pontoons

10 Great Small Pontoons Your Boat Was Expensive—Do You Really Trust a $2 Rope From the Dollar Store to Secure It?

Your Boat Was Expensive—Do You Really Trust a $2 Rope From the Dollar Store to Secure It? Do I Need Insurance Coverage Against Ice or Freezing Damage?

Do I Need Insurance Coverage Against Ice or Freezing Damage? What Kind Of Insurance Coverage Do I Need?

What Kind Of Insurance Coverage Do I Need? What About Salvage?

What About Salvage? Boat Insurance or Yacht Insurance?

Boat Insurance or Yacht Insurance? The Best Bowriders For The Money

The Best Bowriders For The Money

The Wildest Concept Yachts

The Wildest Concept Yachts

2016 Trifecta 200 Series 220FCR

2016 Trifecta 200 Series 220FCR 2016 Harris Grand Mariner SL 270 DL

2016 Harris Grand Mariner SL 270 DL 2016 Crestliner Authority 2050

2016 Crestliner Authority 2050 2016 Harris Grand Mariner SL 230 DLDH

2016 Harris Grand Mariner SL 230 DLDH