Buying insurance for your boat can be daunting at first, since there are so many new terms to understand. Understanding the basics is the first step in determining what kind of coverage you need.

Loss or Damage

Where coverage of the boat itself is concerned, the three terms you will most-often hear are “agreed value,” “actual cash value” and “replacement cost.”

As implied, an agreed value policy insures the boat to a value that is agreed upon between the owner and the insurer. In the event of a total loss, the policy will pay the full insured amount. If the boat has appreciated in value, you still get what you agreed to and not a penny more.

Actual cash value coverage means the insurance company will pay the actual cash value of the boat on the day it was lost. In other words, the value of the boat, less depreciation.

Replacement cost coverage means that the insurance company will pay the cost to replace the boat, regardless of whether its value has gone up or down.

Replacement cost coverage is generally considered to be the best type of coverage, since there is no haggling about the boat’s value. It’s also the best type of coverage if the boat needs to be repaired, rather than replaced. If you damage your 10 year-old boat, for example, an actual cash value policy will only cover the cost of 10 year-old replacement parts. New parts would be considered an upgrade, since they’re not depreciated. However, since aged parts are almost impossible to find, the boat yard will most likely install new ones, leaving you to pay the difference out of pocket.

Most boaters will prefer to buy a comprehensive policy that covers against a range of perils unrelated to your actual boating activity, such as vandalism and theft.

Personal Injury

Boat policies often extend to cover boat passengers as well. Your boat policy may include a provision to cover your medical bills, lost wages, and pain and suffering if you’re hit by another boater who doesn’t have their own insurance, for example.

Liability

Personal injury liability coverage protects you from being sued or having to pay out of pocket if you hurt another boater during an accident. The coverage typically includes medical bills, lost income, pain and suffering, and legal expenses.

Property damage liability coverage protects you if your boat accidentally cause damage to someone else’s property.

Property damage liability offers similar protection against the cost of any damage you cause to other boats, docks or property. Another kind of coverage to look for is guest passenger liability, which means you’re covered when someone else is using your boat.

Additional Coverage

Apart from insuring the boat itself, most boat policies will also provide coverage for a number of other things we might not think about at first. Most (but not all) policies will cover the cost of an emergency tow, for example, or provide coverage for personal effects like cell phones or cameras that are damaged or lost in a boating accident. Some policies will even offer a loss-of-use option, which allows you to rent another boat while yours is being repaired.

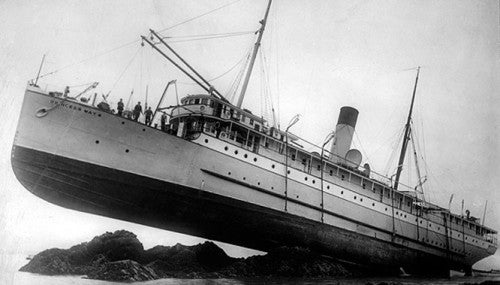

If the policy doesn’t include it, see if you can add coverage for salvage and wreck recovery. If you ever suffer a major accident with your boat, this coverage can save you a fortune in fees.

The Fine Print

Discuss your boat insurance needs with an insurance broker that specializes in marine policies. Their experience can prove invaluable, and they can suggest forms of coverage you might not have thought of, such as insurance against damage caused by animals (a huge consideration if you live in the north and store your boat over the winter), or severe storms like hurricanes and tornadoes should you live in areas where they are prevalent.

Fort Lauderdale International Boat Show Preview

Fort Lauderdale International Boat Show Preview 10 Best New Boat Accessories at IBEX 2021

10 Best New Boat Accessories at IBEX 2021 2022 Sea-Doo Switch Pontoon Boat Lineup Unveiled

2022 Sea-Doo Switch Pontoon Boat Lineup Unveiled BRP Enters Fishing Boat Market with Purchase of Alumacraft Boat

BRP Enters Fishing Boat Market with Purchase of Alumacraft Boat Volvo Commits To Electric Power By 2021

Volvo Commits To Electric Power By 2021 Kemimoto 4 Bow Bimini Top and Boat Bumper Review

Kemimoto 4 Bow Bimini Top and Boat Bumper Review Starweld Victory 20 Review

Starweld Victory 20 Review Princecraft Ventura 23 RL Review

Princecraft Ventura 23 RL Review Lund 2075 Pro V Review

Lund 2075 Pro V Review Scout 281 XSS Review

Scout 281 XSS Review Fuel Saving Tips For Boaters

Fuel Saving Tips For Boaters Best Boating Accessories

Best Boating Accessories Best Boating Apps

Best Boating Apps 5 Pontoon Boats That Are Made To Fish

5 Pontoon Boats That Are Made To Fish 10 Great Small Pontoons

10 Great Small Pontoons Your Boat Was Expensive—Do You Really Trust a $2 Rope From the Dollar Store to Secure It?

Your Boat Was Expensive—Do You Really Trust a $2 Rope From the Dollar Store to Secure It? Do I Need Insurance Coverage Against Ice or Freezing Damage?

Do I Need Insurance Coverage Against Ice or Freezing Damage? What Kind Of Insurance Coverage Do I Need?

What Kind Of Insurance Coverage Do I Need? What About Salvage?

What About Salvage? Boat Insurance or Yacht Insurance?

Boat Insurance or Yacht Insurance? The Best Bowriders For The Money

The Best Bowriders For The Money

Sailfish 312CC Review

Sailfish 312CC Review

The Wildest Concept Yachts

The Wildest Concept Yachts

2016 Trifecta 200 Series 220FCR

2016 Trifecta 200 Series 220FCR 2016 Harris Grand Mariner SL 270 DL

2016 Harris Grand Mariner SL 270 DL 2016 Crestliner Authority 2050

2016 Crestliner Authority 2050 2016 Harris Grand Mariner SL 230 DLDH

2016 Harris Grand Mariner SL 230 DLDH