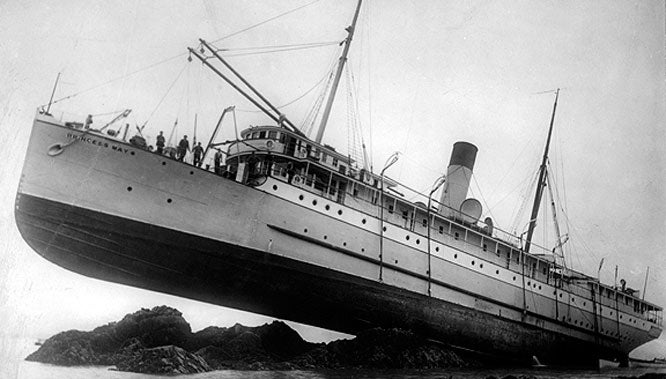

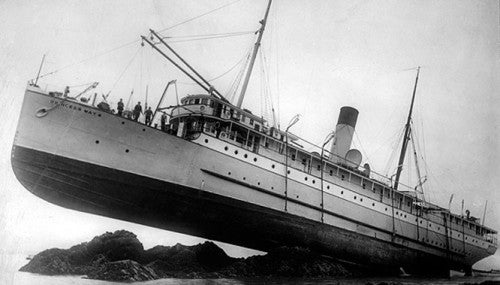

It’s every boater’s nightmare – an unexpected storm puts you and your crew in an emergency situation, requiring rescue by the Coast Guard as the boat is blown up onto the rocks.

Depending on your insurance situation, that may not be the end of your nightmare, but only the beginning. Of all the costs a boater might face, expenses for salvaging a boat or recovering a wreck can easily top them all. Worse still, these fees may not be covered by your insurance policy.

Contrary to popular belief, when your boat goes down or is wrecked on a shoal, you can’t just call the insurance company and walk away. You still own the boat, which is now a hazard to navigation and a potential environmental issue. The responsibility of removing it and cleaning up the mess is yours and yours alone.

No Problem! I’m Covered For Emergency Tows!

While many boat policies will include coverage for emergency towing, not all include provision for salvage. Towing and salvage are completely different things in the eyes of an insurance company. They’re also different things to the Coast Guard, and under the terms of maritime law.

Proper insurance can cover you against the cost of environmental pollution resulting from an incident with your boat. While it may not cost too much to raise a boat that sunk at the dock, the cost of cleaning up spilled fuel could be substantial.

Towing coverage is intended to cover the cost of a tow back into the marina should your vessel experience engine trouble at sea. Salvage, on the other hand, generally refers to recovering a vessel that has run hard aground. Check your policy or call your broker to determine your level of coverage.

Good News! They Saved The Boat!

It starts off well – the salvage company got the boat off the rocks, and apart from a few scratches there’s no real damage at all. Good news, right?

Perhaps. But since there was no real damage to the boat, the insurance company could decide that you’ve suffered no real loss, and refuse to pay for anything. Unless you have a policy that specifically covers it, that would leave you on the hook for the salvage bill, which could come out to thousands of dollars.

Ensuring that your policy specifically provides coverage for salvage can save you from this messy situation, by providing a clear basis for a claim.

Bad News! The Boat’s A Write-Off!

It starts off badly – the salvage company couldn’t get the boat off the rocks in one piece because it was so badly damaged in the storm. It’s a complete write-off.

While your boat insurance will cover replacing the boat, you could still be on the hook for the cost of clearing away the old wreck, along with the cost of cleaning up any fuel spills or other environmental damage. That’s a bill that could easily run into the tens of thousands of dollars.

Insurance coverage for salvage usually (but doesn’t always) include provisions for this worst-case scenario. It’s a good idea to speak to your broken and confirm that your policy does include a provision for not only salvage costs, but also wreck removal and environmental mitigation. This usually falls under protection and indemnity coverage.

Fort Lauderdale International Boat Show Preview

Fort Lauderdale International Boat Show Preview 10 Best New Boat Accessories at IBEX 2021

10 Best New Boat Accessories at IBEX 2021 2022 Sea-Doo Switch Pontoon Boat Lineup Unveiled

2022 Sea-Doo Switch Pontoon Boat Lineup Unveiled BRP Enters Fishing Boat Market with Purchase of Alumacraft Boat

BRP Enters Fishing Boat Market with Purchase of Alumacraft Boat Volvo Commits To Electric Power By 2021

Volvo Commits To Electric Power By 2021 Starweld Victory 20 Review

Starweld Victory 20 Review Princecraft Ventura 23 RL Review

Princecraft Ventura 23 RL Review Scout 281 XSS Review

Scout 281 XSS Review Sailfish 312CC Review

Sailfish 312CC Review Fuel Saving Tips For Boaters

Fuel Saving Tips For Boaters Best Boating Accessories

Best Boating Accessories Best Boating Apps

Best Boating Apps 5 Pontoon Boats That Are Made To Fish

5 Pontoon Boats That Are Made To Fish 10 Great Small Pontoons

10 Great Small Pontoons Your Boat Was Expensive—Do You Really Trust a $2 Rope From the Dollar Store to Secure It?

Your Boat Was Expensive—Do You Really Trust a $2 Rope From the Dollar Store to Secure It? Do I Need Insurance Coverage Against Ice or Freezing Damage?

Do I Need Insurance Coverage Against Ice or Freezing Damage? What Kind Of Insurance Coverage Do I Need?

What Kind Of Insurance Coverage Do I Need? What About Salvage?

What About Salvage? Boat Insurance or Yacht Insurance?

Boat Insurance or Yacht Insurance? The Best Bowriders For The Money

The Best Bowriders For The Money

The Wildest Concept Yachts

The Wildest Concept Yachts

2016 Trifecta 200 Series 220FCR

2016 Trifecta 200 Series 220FCR 2016 Harris Grand Mariner SL 270 DL

2016 Harris Grand Mariner SL 270 DL 2016 Crestliner Authority 2050

2016 Crestliner Authority 2050 2016 Harris Grand Mariner SL 230 DLDH

2016 Harris Grand Mariner SL 230 DLDH