If you live in the northern part of the world, cold winter weather puts special demands on your boat – and your boat insurance. It doesn’t matter if you live in moderate latitudes where you can leave your boat in the water through the winter, or if you live farther north and pull your boat out for winter storage – frigid temperatures represent unique perils which may not be covered under your boat’s insurance policy.

Although it’s not widely advertised, the reality is that many insurance companies will simply refuse to honor claims against damage caused by ice and freezing during the winter lay-up period unless you can prove that the boat was professionally winterized and prepared for storage by a qualified marine technician.

“If the engine is not properly winterized then any water remaining inside its internal passages will freeze and can cause cracks,” says broker Andrew Robertson, with Skippers Plan Yacht Insurance in Toronto, Canada. “Unfortunately, the insurance company has no way of knowing whether a person who winterized their boat themselves did the job properly, and that’s why they typically demand a receipt to prove the work was conducted by a professional mechanic. While it may be tempting to save a few bucks and do the work yourself, going that route could leave you out in the cold if something goes wrong.”

Demanding proof that the boat was professionally prepped for winter also guards against insurance fraud, says Robertson.

“In the event of a claim the insurer wants to make certain that any damage actually did result from an accident and not through negligence,” said Robertson. “It protects insurers from fraudulent claims made by those who might think they can just put the boat away without winterizing it properly, hoping the block will crack so they get a new engine out of it.”

As always with insurance, it’s important to speak with your broker to ensure that both yours and the insurance company’s expectations are clearly understood.

“Most insurance policies contain what are called warranties, which are prescribed activities that the boat owner must complete in order to prevent avoidable claims,” said Jared Chartrand, president of Northstar Marine Insurance. “Winterization is a fairly typical warranty, and that’s why they normally require the boat owner provide a receipt to prove that winterization work was conducted by a qualified marine technician. Where it can get sticky is if you choose to keep your boat in the water over the winter, because it can be argued that any damage that does result from freezing or from ice was preventable and the owner chose not to take action to prevent it from happening.”

So what happens if you do everything as you’re asked and come spring, you discover evidence of ice or freezing damage?

“Normally that’s a pretty short conversation between the owner and the marina that performed the work for them,” says Chartrand. “The insurance company would go after them to sue against the value of the damages, but usually that communication is direct between the customer and the marina. If you take your car in to the shop and they damage something, you don’t normally call the insurance company first – you call the garage and get them to straighten it out. And that’s how it is with boats. The insurance company will get involved if it has to, but any reputable marina will look after the customer straight away.”

Both Robertson and Chartrand advise boaters to call their broker and ensure that they clearly understand how their insurance coverage relates to ice and freezing damage. It’s just a phone call, and it could save you thousands.

Fort Lauderdale International Boat Show Preview

Fort Lauderdale International Boat Show Preview 10 Best New Boat Accessories at IBEX 2021

10 Best New Boat Accessories at IBEX 2021 2022 Sea-Doo Switch Pontoon Boat Lineup Unveiled

2022 Sea-Doo Switch Pontoon Boat Lineup Unveiled BRP Enters Fishing Boat Market with Purchase of Alumacraft Boat

BRP Enters Fishing Boat Market with Purchase of Alumacraft Boat Volvo Commits To Electric Power By 2021

Volvo Commits To Electric Power By 2021 Starweld Victory 20 Review

Starweld Victory 20 Review Princecraft Ventura 23 RL Review

Princecraft Ventura 23 RL Review Scout 281 XSS Review

Scout 281 XSS Review Sailfish 312CC Review

Sailfish 312CC Review Fuel Saving Tips For Boaters

Fuel Saving Tips For Boaters Best Boating Accessories

Best Boating Accessories Best Boating Apps

Best Boating Apps 5 Pontoon Boats That Are Made To Fish

5 Pontoon Boats That Are Made To Fish 10 Great Small Pontoons

10 Great Small Pontoons Your Boat Was Expensive—Do You Really Trust a $2 Rope From the Dollar Store to Secure It?

Your Boat Was Expensive—Do You Really Trust a $2 Rope From the Dollar Store to Secure It? Do I Need Insurance Coverage Against Ice or Freezing Damage?

Do I Need Insurance Coverage Against Ice or Freezing Damage? What Kind Of Insurance Coverage Do I Need?

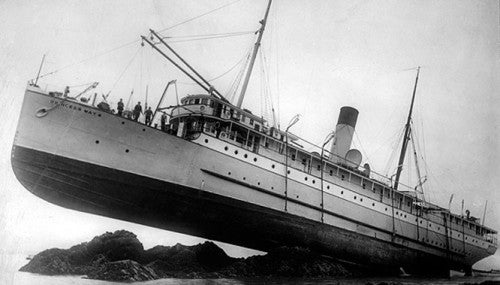

What Kind Of Insurance Coverage Do I Need? What About Salvage?

What About Salvage? Boat Insurance or Yacht Insurance?

Boat Insurance or Yacht Insurance? The Best Bowriders For The Money

The Best Bowriders For The Money

The Wildest Concept Yachts

The Wildest Concept Yachts

2016 Trifecta 200 Series 220FCR

2016 Trifecta 200 Series 220FCR 2016 Harris Grand Mariner SL 270 DL

2016 Harris Grand Mariner SL 270 DL 2016 Crestliner Authority 2050

2016 Crestliner Authority 2050 2016 Harris Grand Mariner SL 230 DLDH

2016 Harris Grand Mariner SL 230 DLDH